Almost none of Australia’s top 20 food businesses have begun to assess nature-related impacts, dependencies, and risks in their value chains, with even less disclosing them, a report released today by the Australian Conservation Foundation (ACF) has found. In the first assessment of its kind, the ACF says it hopes its The Future of Food benchmark report will help shift the food system to “strive for greater outcomes”.

The benchmark assessed companies on 37 sustainable practice indicators across four themes: Risk Assessment and Disclosure, Nature Targets, Strategy and Action, and Governance. It also looked at the companies’ commitment to transparent reporting.

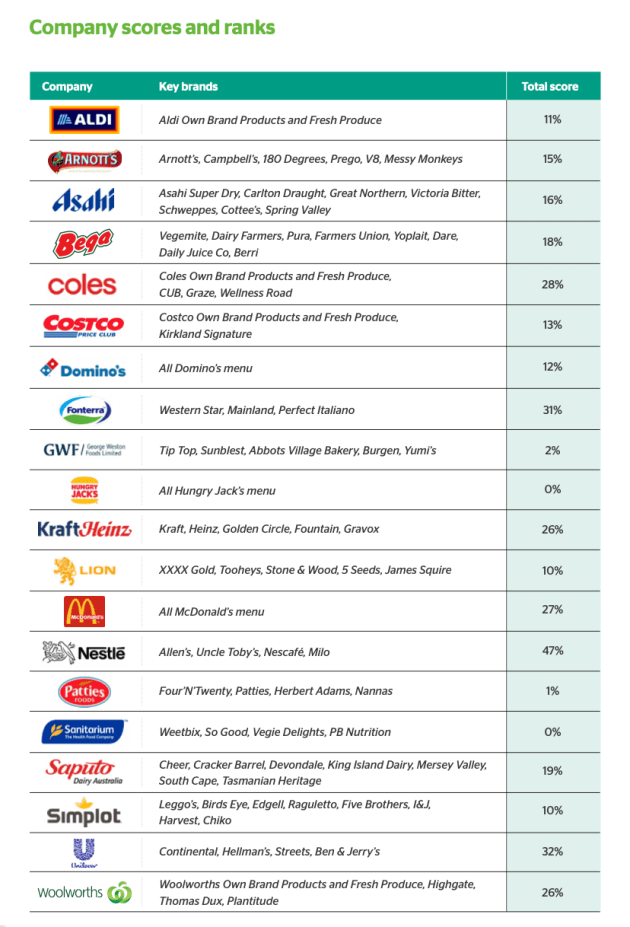

The average score was a sobering 17 per cent across the 37 indicators assessed in the benchmark. Not one company received a pass mark above 50 per cent.

Only nine companies could demonstrate they had traced any of their material commodities back to the farms they were produced on. But seven of them did so for less than 25 per cent of their commodities.

Lead author, Bonnie Graham, told Food & Drink Business that was one of the most surprising findings.

“That the majority don’t have traceability back to the farm level is a big concern because it is such a foundational step. Without knowing what farm your produce comes from, companies have no way of putting strong policies and systems in place to mitigate any damage that is occurring at that level,” Graham said.

She added that without that traceability, any actions taken tend to be quick fixes or band-aid solutions at a head office level that don’t have genuine flow-on impacts throughout the supply chain.

“This lack of value chain visibility is extremely concerning as companies cannot assess their impacts and dependencies or manage nature-related risks without first knowing who their suppliers are or which ecosystems and biomes their value chains interact with.

“Given Australia has at least 89 unique ecological bioregions, a ‘one size fits all’ approach using country-level traceability data only cannot be relied upon,” the report said.

The purpose of the report was to measure how these companies are grappling with nature-related issues, not to assess their impacts on nature.

“We designed the research process to be as collaborative with companies as possible. We approached all of them and gave them the opportunity to be involved in the actual development of the criteria and met with the majority of them throughout the process.

“We very much recognise that nature and nature disclosures is still a very new area for most companies, so it’s not something most are reporting on publicly at this stage, but it doesn’t mean they’re not doing anything to address those issues. We wanted to make sure we were capturing all those behind-the-scenes pieces as well as the public work,” Graham said.

The report found a severe lack of targets to halt or reverse nature damage, with not one company having set water use or water pollution targets applicable to supplier level.

Not one company had conducted a nature-specific risk assessment. In fact, Risk Assessment and Disclosure was the worst performing section in the benchmark. Looking at how companies incorporate value chain visibility and assessment of nature risks, impacts, dependencies and opportunities, the average result was six per cent, 2.3 points out of a possible 39.

Turning to deforestation, Australia has the highest rate of deforestation in the developed world, with around half a million hectares of bush cleared every year.

The report found that the five largest buyers of beef in Australia – Coles, Woolworths, McDonald’s, Hungry Jack’s and Patties – have not set deforestation targets that align with international best practice, despite beef production being a major driver of deforestation in Australia. Aldi was the only major supermarket with a deforestation target.

“Woolworths currently has a partially aligned target, which in essence says we’re not going to eliminate deforestation, we’re going to try and rule it out. The supermarkets have a huge amount of influence over suppliers. For them to set targets sets a really good precedent and send the signal down the supply chain that it needs to be taken seriously,” Graham said.

Australia food businesses are expected to implement commitments to end deforestation by 2025, and ultimately end the conversion of all natural ecosystems, for all value chains they source from directly or indirectly, with a cut-off date of no later than 31 December 2020.

“A lot of the conversations we had with companies is that nature is going to be the next climate. We think that for the time it took for companies to get up to scratch on climate, setting targets, and having a strategy, it will take a much shorter time for nature to reach that point.

“We have mandatory climate reporting coming into play this year, and we would anticipate nature is not too far behind. It is really important companies take this seriously and a lot more beneficial to start earlier than waiting for it to be legislated down the track,” Graham said.

The report said that, as a starting point, all food companies should have a zero deforestation and conversion target, and in most cases should be developing other land use change and water targets.

“The breadth of nature issues can lead to overwhelm, and companies should focus on setting science-based targets and reporting progress on their most material issues first and then building out from there. Targets should be aligned with SBTN and IUCN guidance, or else justified with credible scientific evidence, and should be publicly reported on,” it said.

It said that while there is a groundswell of sustainable and regenerative farmers, innovative food companies, and conscientious consumers leading the way, the work needed for a full systemic transition has “barely crossed the starting line”.

“Companies who act early and seize the opportunities of this transition will thrive, while those who don’t risk being left behind.

“Where there is great challenge, there is great opportunity.”

Read the full report here.