For the sixth consecutive year, Incite is surveying leading Food & Beverage importers and distributors across the Asia Pacific region about current market conditions, in-demand product categories and their predictions for their food and beverage sectors over the next 12 months.

As this year’s survey is underway, here are some of the highlights from last year’s survey of over 2,500 food and beverage importer and distributor contacts surveyed across the Asia Pacific region.

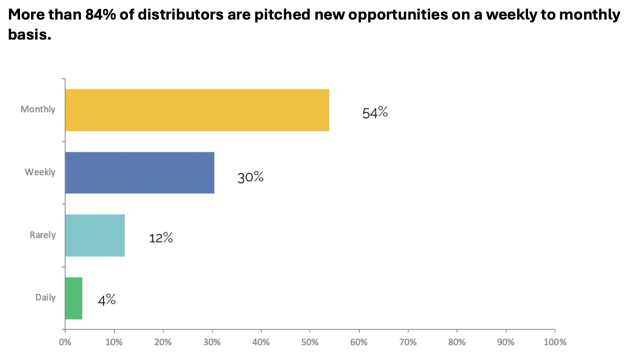

Distributors have shared that while they are presented with new distribution opportunities frequently, their customers are searching for the best value – whether it’s in dollars or taste. Asking consumers to switch brands in a category requires the new brand to have an edge over the incumbent.

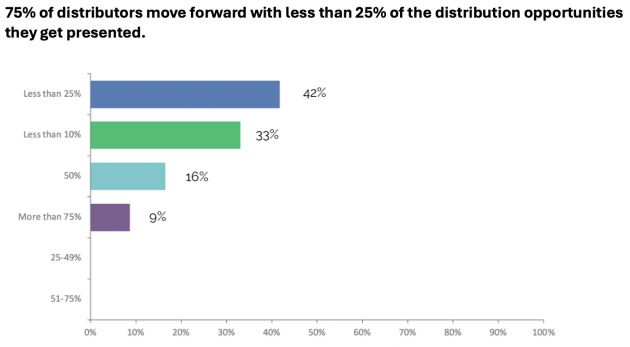

Although there is opportunity, the competition is fierce. Mass market/commodity segments are quite crowded, so a new listing must offer something unique to the retailer’s range.

With limited shelf space, distributors and their retailers look at the brand’s potential to cut through the noise and competition by presenting compelling and well thought out commercial propositions to maintain their listings and grow sales over time with strong local market demand. Brands must put forward a case as to how the new listing will generate incremental growth in the category that it is going after. If space on shelf doesn’t exist, another product will have to be deleted to make way for the new brand.

Historically, price competitiveness dominated as the most important factor when assessing new distribution opportunities. However, customers are now looking for value. They want competitive prices, but they also want superior taste and quality. It can be difficult for brands to find a balance between both.

Grocery distributors shared that launching a product range in a new market without supporting it with marketing and promotion will likely result in failure. Linking traditional in-store activations (price promotions, demos and samplings) with digital marketing efforts have proven to contribute greatly to the success of a brand when launching in new Asia Pacific export markets.

With rising operational costs, distributors want to make sure that the brands they partner with can be priced well, so they sell. A common theme that often comes up is inflation (i.e. cost of living), which is affecting both consumer behaviour (e.g. shopping on basket spend rather than per 100g value) and retailer behaviour (e.g. changes in brand investment expectation and a renewed focus on optimising shelf ranges).

Importers and distributors across a range of markets shared that their outlook for the grocery sector in 2024 was positive, with an average rating of 3.5/5 (1 = negative, 5 = positive). Although distributors have been commenting that they are operating in a complex, fast-changing environment, there continues to be demand for imported food and beverage products across the APAC markets that Incite operates in, but there has been a shift away from a reliance on imported mass-market products with local producers and brands becoming more prevalent in this segment.

As markets mature, it is natural that local producers will see the opportunity to manufacture goods closer to the end consumer without having to rely on freight and timing considerations. Regional manufacturers will also put a unique spin on some products to make them more attractive to local tastes and preferences.

There is strong demand for mid-to-premium priced imported products, but customers continue to expect value for money in their purchases making affordable price positioning vital. From an operational perspective throughout APAC markets, distributors have faced challenges with the ongoing disruptions in sea freight across key shipping routes and issues with container availability. This has directly affected the consistency of supply from UK and EU-based brands.

Categories and segments that are showing signs of growth include functional beverages and healthy snacking. Consumers are showing an appetite towards new and innovative products that support an active and healthy lifestyle.

In more mature APAC markets, plant-based foods and drinks are growing in popularity. Consumers recognise the importance of protein as part of a balanced diet, and with growing concerns for health and animal welfare, plant-based products continue to grow in popularity.

To download the 2023 Asia Food and Beverage Distributor Survey Report, click here.