As the effects of the pandemic lessen and public outdoor mobility and tourist arrivals resurge, the consumption of on-premise and on-the-go ice cream has been bolstered, with GlobalData predicting the Australian ice cream market will expand to $2.7 billion by 2026.

The growth will register a compound annual growth rate (CAGR) of 1.7 per cent.

Bobby Verghese, consumer analyst at GlobalData said that as pandemic restictions lifted, consumers had visited outdoor attractions more often, leading to a dip in at-home consumption of ice cream and an increase in on-premise and on-the-go consumption.

“Additionally, impulse purchases of ice creams resurged, in line with rising consumer footfall at retail stores and on-trade venues. The growing health concerns accentuated by the pandemic also spurred the demand for better-for-you ice creams with less fat,” said Verghese.

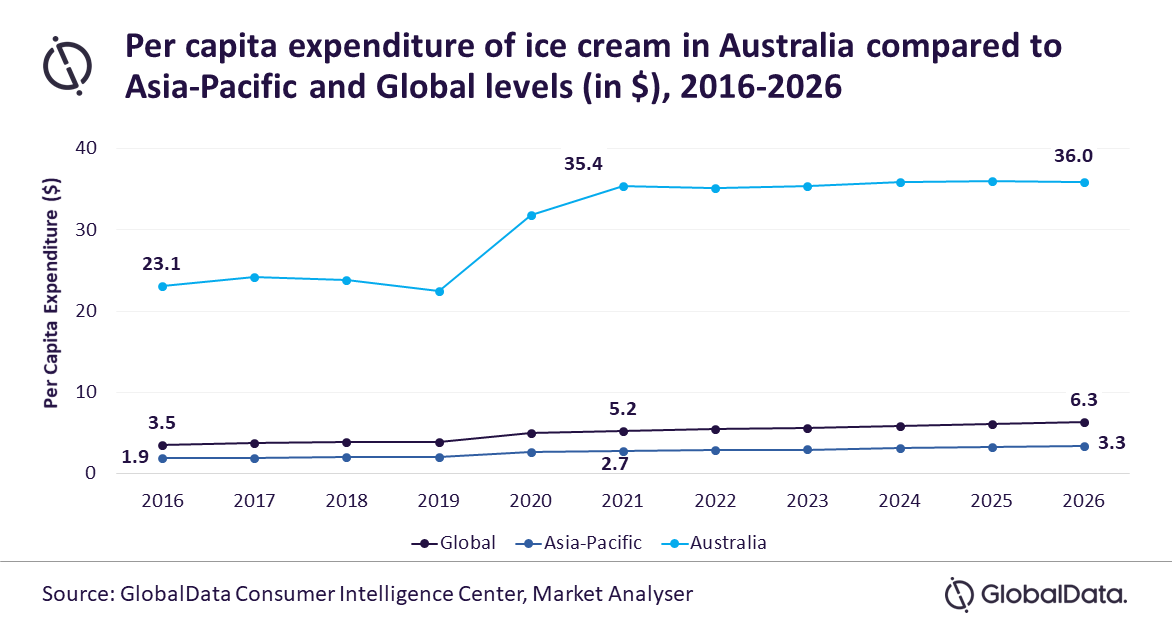

Consequently, the per capita expenditure (PCE) on ice cream in Australia increased from $23.10 in 2016 to $35.40 in 2021, surpassing the regional PCE of $2.70 and the global average of $5.20. Australia’s PCE on ice cream is projected to reach $36 by 2026.

In 2021, hypermarkets and supermarkets was the leading distribution channels in the Australian ice cream market, followed by food and drinks specialists and convenience stores. Unilever, Australasian Food Group, and Bulla Dairy Foods were the top three companies in the Australian ice cream market in 2021 in value terms, while Blue Ribbon and Magnum were the leading brands.

Verghese said the latest Covid wave in late 2022 was set to suppress the consumption of chilled and frozen foods such as ice cream during the peak summer months from December 2022 through February 2023.

“Moreover, the cost-of-living crisis triggered by the Russia–Ukraine conflict will compel consumers to curtail non-essential purchases or switch to cheaper brands and private labels or smaller packs, thereby slowing market growth.

“However, as the pandemic conditions and inflationary pressure subside, consumers will trade up to premium, and artisanal ice creams with organic and low-fat/-sugar recipes. Vegan alternatives are also expected to gain mass-retail appeal. These healthy alternatives, combined with the launch of new flavours and the resumption of marketing activities, will accelerate ice cream sales in Australia,” said Verghese.