Food and beverage export development agency, Incite, has released the results of its sixth annual survey of importers and distributors across the Asia Pacific Region, finding 97 per cent are actively reviewing new distribution opportunities.

Over 2500 food and beverage importers and distributors were surveyed across Incite’s contact network, to reveal insights on the current state of the sector. The theme for 2025 seems to be change, as both distributors and brands must adapt to shifting consumer preferences and market dynamics.

While new brands (both locally manufactured and imported) are entering export markets across the APAC region, only a select few gain long-term traction. Survey results showed 86 per cent of distributors are being approached by new brands on a daily to monthly basis, and 89 per cent onboard half or less of the new opportunities they receive.

According to respondents, price competitiveness and product quality and taste are the most important factors for distributors when assessing new opportunities.

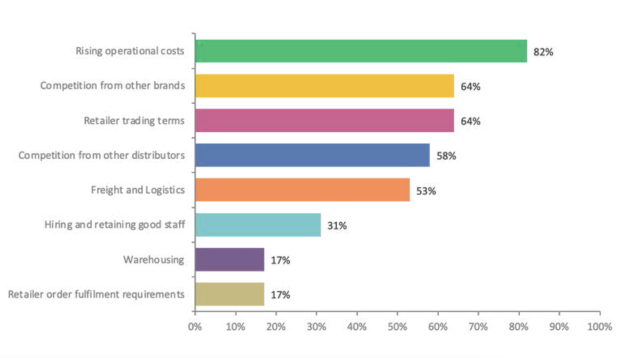

Competition and retailer trading terms are also challenging.

Source: Incite

With the major current challenges distributors are facing being rising costs and competitive trading conditions, brands are having to implement strategies that resonate with both value-conscious distributors and their retailers and consumers.

Incite head of client strategy, Nada Young, said brands need to think carefully about selecting the right distributor for their category, and then how to cut through the noise to differentiate themselves from other brands.

“Pitches must focus on those variables that are most important to distributors, including pricing, shelf life and marketing support. Knowing end-to-end pricing and margin structures allows brands to show how they see their products being positioned against current competing brands in the market,” said Young.

“Understanding marketing norms for that country allows brands to put forth a marketing support package that distributors and retailers will find attractive. Having a grasp of market fundamentals and what is required to survive and grow gives distributors and their customers confidence in the brand.”

The cost of doing business with retailers has increased. Distributors are also facing higher operational costs, meaning decreased margins. To thrive in the current environment, a viable pricing strategy is crucial.

Not everything is looking bad though – despite northern hemisphere freight issues, the number of distributors importing EU and UK products has increased since 2023. Australian and New Zealand brand market share has also grown year-on-year.

Incite commercial director, William Gordon said the survey results resonated with what the company was seeing during negotiations with distributors, and added the following critical points:

- Pricing versus Value – A viable pricing strategy is crucial. We've seen how economic conditions have suppressed demand in the super-premium category. However, there is still opportunity in the mid-to-premium segment, provided consumers feel they're getting value, whether through taste, quality, or health benefits.

- Margins and Shelf Life – Margins are tighter than ever for distributors, and shelf life has become a critical factor. Products that generate higher product returns (also known as wastage) due to short shelf life can result in heavy losses, making this a key point of consideration for distributors.

- Marketing Plans – Grocery buyers increasingly expect brands to come prepared with well-developed marketing strategies before they will confirm listings. For distributors, a solid marketing support package signals a commitment to the success of the launch and future growth.

Consumer trends

In the face of global inflation and economic challenges, consumers are increasingly focused on finding value. Results show regular price promotions have become essential as shoppers actively seek out the best deals, and below the line (in-store) marketing support from the brand is vital to ensure sales are supported.

Importers and distributors are staying positive though, with an average 3.32 out of 5 on a 1-5 scale, where 1 represented a negative outlook, and 5, a positive. In terms of grocery product trends, dairy and savoury snacks are in demand, and there is more interest in plant-based, organic and health foods.

Source: Incite

Incite head of client growth, Cameron Gordon, said dairy and savoury snacking remain the top two in-demand categories year-on-year (YOY) with growing demand for dairy and dairy-based products across Southeast and North Asia.

“Consumers are increasingly levelling up to premium natural dairy products (vs. more processed alternatives) as health awareness increases. Frozen foods have seen a decrease from 37 per cent to 30 per cent YOY, which may be due to post-Covid consumer shopping habits returning to more frequent in-store shopping,” said Gordon.

“Confectionary has decreased from 35 per cent to 25 per cent YOY, which may be influenced by a decrease in sugar consumption due to increased health consciousness. In addition to this, demand for organic foods has increased from 23 per cent to 27 per cent YOY. Functional snacking has maintained YOY.”