The latest quarterly Consumer Price Index (CPI) data from the Australian Bureau of Statistics shows that while consumers were paying higher prices for fruit and vegetables, there was some relief in overall food price inflation in, Rabobank says.

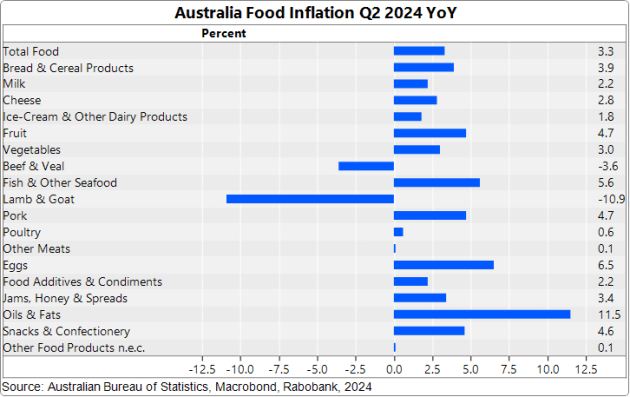

The June 2024 quarter data saw overall annual food price inflation (compared to prices in the June 2023 quarter) at 3.3 per cent, easing from 3.8 per cent in the March quarter.

RaboResearch senior food retail analyst, Michael Harvey, said this was the lowest quarterly food price inflation number since December 2021 (when it was 1.9 per cent).

“While still above the 10-year-average of Australian food price inflation, which is 2.7 per cent, it is in the context of the peak of food price inflation we saw reached in December 2022 of a very high 9.2 per cent,” Harvey said.

He added that inflation in the food service category was also at its lowest level since the March 2022 quarter – at 4.1 per cent for restaurant and 4.3 per cent for takeaway food service.

But while overall food price inflation had eased for the sixth consecutive quarter, Harvey said there were “mixed results inside the food basket”.

“There was a general slowdown in the rate of inflation across most key categories including dairy, bakery, cereals and spreads in the June quarter,” he said. “There were however some pressure points for consumers, with cooking oils a clear standout, seeing inflation rising back to 11.5 per cent.

“There are global pricing pressures coming through in the cooking oil category, with higher palm, soy and sunflower oil prices. And locally there have been supply issues with Australian olive oil, with the olive harvest impacted by cold weather and a shorter-than-average growing season.”

Harvey said fresh produce also saw higher inflation with fruit and vegetable prices up 4.7 per cent and 3.0 per cent respectively on 12 months ago.

“This was driven by poor weather impacting fresh produce, including tomatoes, capsicums, grapes, blueberries and strawberries,” he said.

In the meat aisle, Harvey said, all meat saw price declines from 12 months ago, except pork, poultry and seafood.

But he added there may still be some “sticker shocks” for consumers ahead.

“We would expect to see retail prices for red meat rise a little off the back of higher livestock prices that will be coming through the supply chain, and there is some ‘upside risk’ in relation to egg prices if the bird flu outbreak worsens,” he said.

A key watch in the September quarter CPI data would be fresh produce, which will be impacted by the growing conditions through winter.

For the chocolate/confectionary category, there may also be some price pressure ahead with higher global cocoa and sugar prices still flowing through the system.