The Australian wine market is forecast to grow by 4.1 per cent between 2021–2026 as the impacts of Covid reduce, data and analytics company GlobalData reports.

With the severity of COVID-19 dissipating, consumers have started dining out and socializing more often, and there is now a resurgence in tourism activity. However, GlobalData says pandemic-induced habits will continue to influence the product choices of Australian wine consumers.

Against this backdrop, the Australian wine market will grow from $9.8 billion in 2021 to $12.2 billion by 2026, registering a compound annual growth rate (CAGR) of 4.6 per cent in that period.

GlobalData’s report, Australia Wine - Market Assessment and Forecasts to 2026 reveals that the market growth will be primarily driven by the fortified wine category, which is set to register the fastest value CAGR of 5.7 per cent. The category will be followed by still wine with 4.6 per cent and sparkling wine with 3.9 per cent.

GlobalData consumer analyst Bobby Verghese said the pandemic had accentuated the health and wellness, and experimentation trends among Australian wine drinkers.

"Health-conscious millennials and Gen Z consumers are drinking less wine or less often to curb their alcohol intake. Wine drinkers are opting for quality over quantity, purchasing premium wines to indulge themselves on special occasions instead of buying cheap wines for everyday drinking. Young consumers are also less loyal to popular labels and are exploring new wine varieties that focus on novelty and personalization in the recipe or packaging,” said Verghese.

Hypermarkets and supermarkets were the leading distribution channel in the Australian wine market in 2021, followed by food and drinks specialists and online stores.

Brick-and-mortar retailers are expected to adopt omnichannel strategies to offer shoppers the best of both offline and online retail worlds. Wine producers are also investing in direct-to-consumer channels to tap the booming ecommerce wine market.

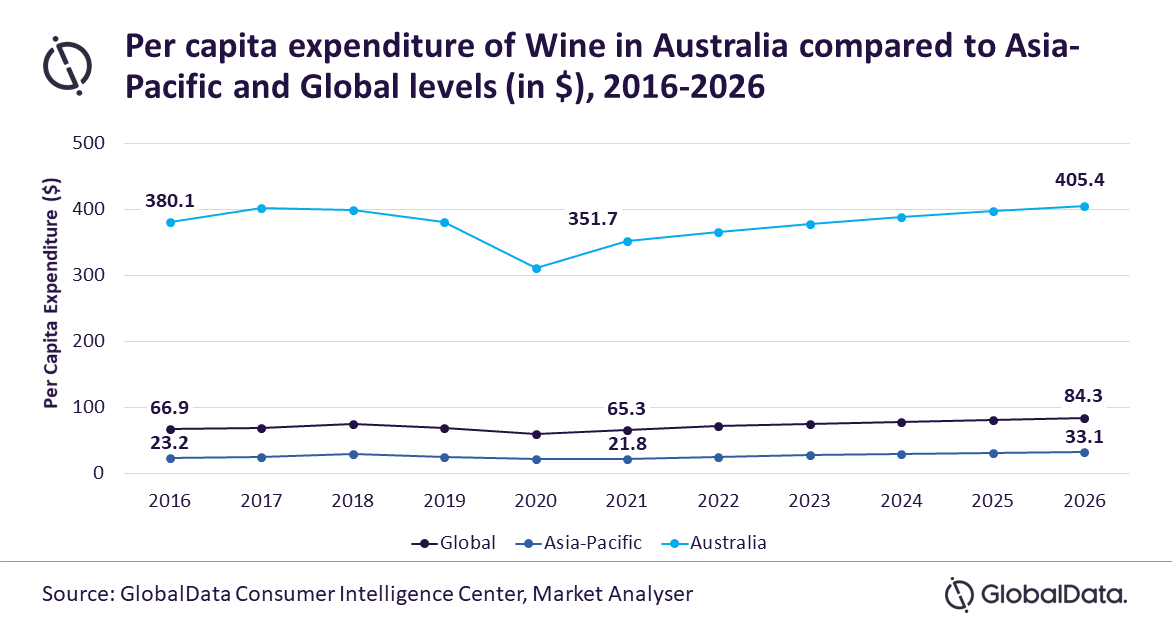

The per capita expenditure (PCE) on wine in Australia decreased from $380.1 in 2016 to $351.7 in 2021. Despite this decline, Australia’s PCE on wine surpassed the global average of $65.3, and the regional average of $21.8 in 2021. The PCE of wine will surge to $405.4 by 2026 as more consumers opt to drink less and go for premium wines, the company said.

Accolade Wines, Treasury Wine Estates, and Pernod Ricard were the top three companies in the Australian wine market in volume terms in 2021, and Rosemount Estate, Stanley Wines, and Yellowglen were the leading brands.

“As the pandemic is brought under control, and economic and social activities normalize, consumer spending on wine will increase. The Australian wine market landscape will evolve as wine producers adapt to the changing consumer choices in the post-pandemic years,” said Verghese.