The Australian Tax Office’s (ATO) first annual Research & Development Tax Incentive Transparency Report reveals $11.2 billion in expenditure was claimed in 2021/22. Tassal Group reported the seventh highest claim with its total R&D expenditure $55,821,520. The inaugural report looks at the 2021-22 income year and the data the business reported in its company tax return.

The R&D Tax Incentive program incentivises companies, regardless of size or industry, to perform R&D activities they may not otherwise undertake due to the associated costs and risks involved.

The federal government announced a “strategic examination of Australia’s R&D system” in the May budget as part of the Future Made in Australia package.

According to the Australian Academy of Science, investment in Australia’s science and research system is spread over 227 programs and 15 federal portfolios, with multiple ministers and departments having key responsibilities.

Academy President, Professor Chennupati Jagadish, said, “A strategic examination of Australia’s R&D system is the first step to align national effort across the whole of government, industry, universities and philanthropy to create an environment where investment is effective, strategic and scaled.”

(The Academy also released an interactive science and research snapshot following this year’s budget.)

But national employer organisation, the Australian Industry Group (AiGroup), expressed “significant concerns” regarding the ATO’s new reporting requirements for the R&D Tax Incentive.

The AiGroup said the decision by the ATO to share details of the 11,545 companies using the R&D Tax Incentive, “a program already known for its complexity and uncertainty”, has made it even less appealing for businesses.

Findings

Public and multinational businesses claimed the most on R&D in the 2021–22 income year with a total of $4.9 billion, followed by privately owned and wealthy groups with $4.1 billion, and lastly small businesses with $2.2 billion in R&D expenditure claimed.

The average claim per entity for public and multinational businesses was $3,095,496, privately owned and wealthy groups, $931,824, and small businesses, $395,191.

The breakdown of reporting companies was:

- 48% (5574) small businesses (companies that are carrying on a business with an aggregated turnover of less than $10 million);

- 38% (4370) privately owned and wealthy groups (companies and their associated subsidiaries with an annual turnover of more than $10 million that aren't public groups or foreign owned); and

- 14% (1598) public and multinational businesses (publicly listed Australian and multinational companies).

The report reveals 5574 SMEs were involved in the program, while public and multinational businesses invested the most in R&D, with $4.9 billion in expenditure claimed.

Highlights

- total amount of R&D expenditure claimed in the 2021–22 income year is $11.2 billion;

- 11,545 companies claimed R&D expenditure in the 2021–22 income year;

- public and multinational businesses invested the most on R&D in the 2021–22 income year, with a total of $4.9 billion claimed;

- small businesses had the highest percentage of claimants, making up 48% of the total population;

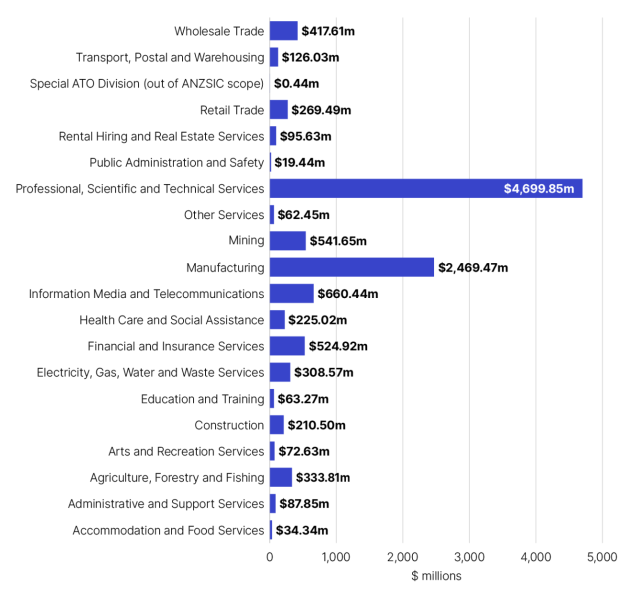

- the industry with the highest number of claimants across all business populations is the professional, scientific and technical services industry, making up 43% of claims; and

- Australian-owned companies accounted for 97.8% of this year’s population, with 11,286 reporting R&D expenditure.

But AiGroup CEO, Innes Willox, said business R&D investment fell to 0.89 per cent of GDP in 2021-22, the lowest in 20 years. Australia has dropped from 12th to 19th in the OECD R&D ranking and is now lower than all G7 major economies.

“It is telling that this data reveals that of the $20.6 billion of business R&D conducted in 2021-22, only 54 per cent was subsequently claimed to the ATO under the R&D Tax Incentive.

“This low utilisation rate points to design inefficiencies that are preventing our R&D-active businesses from properly accessing the R&D Tax Incentive,” Willox said.

He said the AiGroup “fully supports” transparency in the allocation and use of government funding, but the effectiveness of the new reporting requirements in enhancing program compliance was “questionable”.

“If the ATO is aware of the entities engaging in non-compliant activities, it should take direct action against these bad actors rather than sharing the details of participants in the program,” Willox said.

“Ironically, the new reporting requirements may inadvertently benefit the bad actors the ATO aims to eliminate. By providing a detailed ‘shopping list’, the ATO has potentially armed these entities with the information needed to navigate and exploit the system further.

“We are committed to working closely with our members and, as the Strategic Examination of Australia’s R&D System progresses, we will actively engage with stakeholders to advocate for a more effective and less burdensome compliance framework,” he said.